The Company

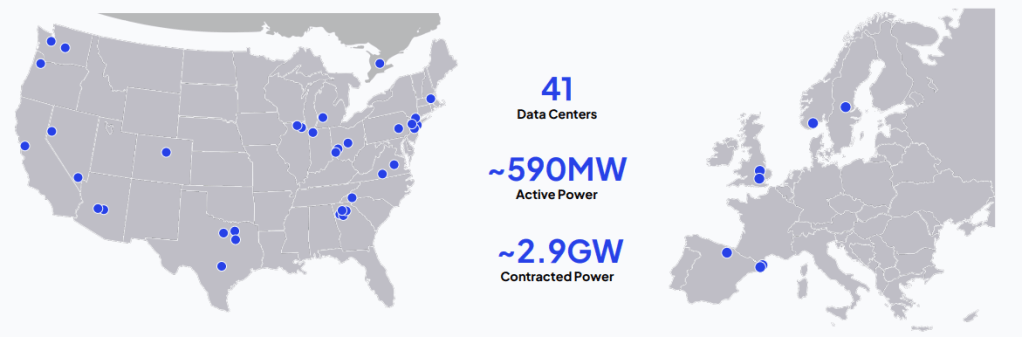

CoreWeave, Inc. is a cloud computing company specializing in high-performance GPU infrastructure for AI and machine-learning workloads. Originally founded in 2017 as Atlantic Crypto to mine Ethereum, it pivoted in 2019 to become CoreWeave—a provider of GPU-as-a-Service (GPUaaS) and AI compute services via its own data centers across the U.S. and Europe.

Bull Thesis

- GPU AI service provider seeing powerful tailwinds of the AI Infrastructure build out.

- 55 Bill$ in revenue backlog. Revenue expected to 5X from 2Bill$ in 2024 to 10Bill$ in a few years.

- Hyperscaler validation – Has signed large contracts with Meta & Open AI. In advanced discussions with atleast 2 more hyperscalers. Further potential announcements expected.

- 7% owned by Nvidia and is always first to launch latest Nvidia chips. Mentioned multiple times during Nvidia Earnings Call. Nvidia additionally buys any surplus compute from Coreweave.

Bear Thesis

- Coreweave leases several of their data centers and is not as integrated like some of the other neoclouds like IREN. Large number of data centers ~32 being upgraded / built. Due to their larger dependence on 3rd party providers, delays to build out can cause revenue projections to shift.

- There is a general concern with all the neo clouds that they don’t have any real IP, it is merely a more efficient cloud softwar stack. The Hyperscalers could easily do this inhouse. The capacity that is being leased out by the Hyperscalers may be temporary and a hedge by the larger players to not overspend on Capex.

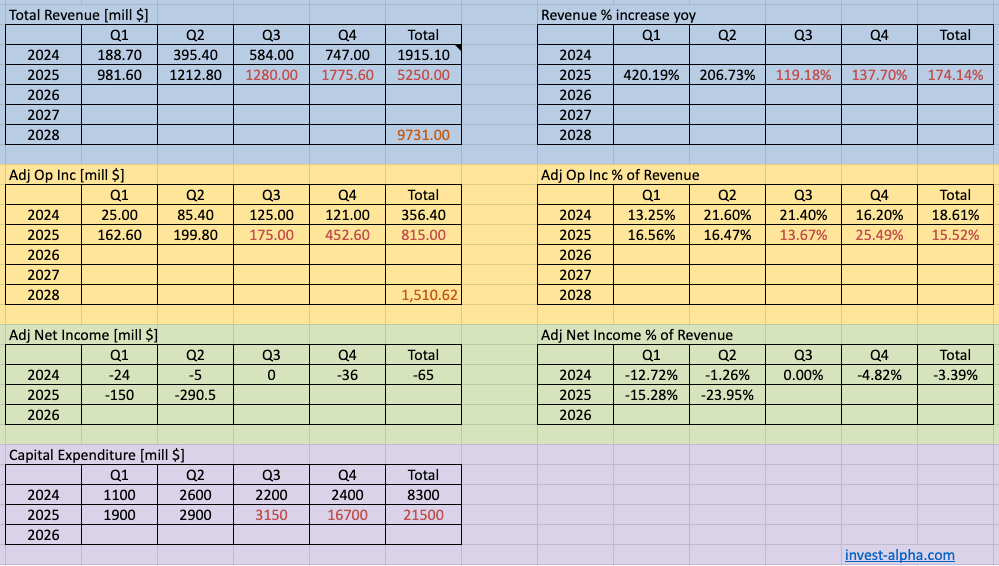

Management Outlook ( Q3 2025)

- Revenue Backlog grew to 55Bill$, increasing from 30.1 Bill $ in Q2.

- Delay in data center buildout due to Core Scientific, impacting about 100 mill$ in Q4 revenue. Customer has agreed to the one quarter delay. Cap Ex for the year was also cut from 21.5 Bill$ to 13 Bill$.

- Power grew sequentially from 120MW to 590MW

- Contracted power capacity has grown to 2.9 GW.

- Grew relationship with a lead hyperscaler.

- Number of customers exceeding 100 mill$ has tripled.

- Crowdstrike, Rakuten among new customers.

- Launched Coreweave Federal for public sector customers such as NASA.

- New CRO – John Jones joins from AWS.

- Will continue to work closely with Core Scientific on the 590MW already leased although acquisition fell through.

- No single customer is more than 35% of revenue backlog.

Financials

Bookings

| Customer | Announced date | Announced / max value | Contract period / term (as disclosed) |

|---|---|---|---|

| OpenAI | Mar 10, 2025 May 8–15, 2025 Sep 25, 2025 | $22.4B | mid 2025 to mid 20230 |

| NVIDIA | Sep 15, 2025 | Up to $6.3B | NVIDIA will purchase unsold/unused CoreWeave capacity through Apr 13, 2032 (per filings/press). |

| Meta | Sep 30, 2025 | Up to $14.2B | Through Dec 14, 2031 with option/extension into 2032 (reported in SEC Form 8-K coverage). |

| Aston Martin Aramco F1 Team | May 22, 2025 | Amount not disclosed (commercial / partnership) | Multi-year partnership (CoreWeave named “Official AI Cloud Computing Partner” — multi-year term disclosed; no $ figure). |

| Microsoft | Reported Nov 4, 2024 | 1.2 Bill$ in 2024. | Described as spend “by end of the decade” |

TAM / CAGR

- CoreWeave cites Bloomberg Intelligence’s estimate of the AI infrastructure market at US $399 billion by 2028, growing at ~38% CAGR from 2023–2028

- Broader AI infrastructure market forecast: reaching ~$356 billion by 2032 with ~29.1% CAGR (2024–2032)

So the latest TAM estimate is in the high‑hundreds of billions, with expected CAGR between ~29%–38%.

Products

| Product / Service | Description | Approx. % of Revenue |

|---|---|---|

| GPU‑based cloud compute (GPUaaS) | GPU leasing for AI training/inference | ~ 90 % |

| CPU compute, storage, networking, managed services | Complementary compute and support services | ~ 10 % |

Coreweave offers bare metal servers, without the virtualization layer which translates to superior performance for AI workloads. This differentiates it from Cloud IAAS offerings such as at the Big 3.

See architecture difference between AI IAAS and Cloud IAAS here

https://invest-alpha.com/stocks/data-center/cloud-infra/

Coreweave Datacenter Locations

Business Model

CoreWeave operates a GPU-as-a-Service model—leasing GPU compute capacity through its cloud platform across 32 data centers. Clients rent GPU-hours (often premium H100/H200 chips), along with additional CPU, storage, networking, managed services and observability software. CoreWeave also offers custom tools (fleet lifecycle controllers, tensorizer, dataset optimizers). Revenue derives mostly from usage-based pricing under multi‑year contracts (Microsoft, OpenAI, others)

Customers

Key customers include:

- Microsoft (~60% of 2024 revenue; multi‑year $10 b IoT compute agreement through 2030)

- OpenAI (~$12 b five‑year contract via private placement at IPO)

- Others: Meta Platforms, IBM, Mistral AI, NovelAI, and Nvidia itself (via supercomputer collaboration)

Competitors

Top 3 competitors with directly competing GPU‑cloud products:

- Lambda Labs – offers GPU‑cloud services for AI training/inference workloads, targeting similar developer enterprises.

- Nebi.us (e.g. Nebius) – specialized AI infrastructure provider competing on GPU compute services.

- Amazon Web Services (AWS EC2 GPU instances) – broader cloud provider but directly competes in GPU cloud compute offerings.

Main Investors

| Investor | % Holding (approx.) |

|---|---|

| Nvidia | ~ 5–6% stake |

| Cisco Systems | Institutional investor, minor (~0.2%) |

| Fidelity Management, BlackRock, Jane Street, Magnetar Capital (via secondary share sale) | Collective minor holdings |

| Coatue Management | Led $1.1 b funding round (2024), ~ valuation impact |

Founding History

- Founded in 2017 in New Jersey by Michael Intrator, Brian Venturo, Brannin McBee (and later Peter Salanki) as Atlantic Crypto, mining Ethereum using GPUs.

- 2019 name change to CoreWeave, shifting focus to GPU cloud services leveraging idle crypto‑mining GPU inventory.

- Between 2022–2023, expanded data centers, invested heavily in Nvidia H100 GPUs, launched startup accelerator program.

- Raised US $1.1 b in 2024 led by Coatue, followed by Cisco’s investment valuing it ~$19–23 b.

- IPO on Nasdaq (symbol CRWV) on March 28, 2025, raising US $1.5 b at $40 per share (valuation ~US $23 b); Microsoft and OpenAI major enterprise contracts and investors during the IPO.

- In July 2025, CoreWeave acquired Core Scientific in a US $9 b all‑stock deal, projecting cost synergies and leasing savings