Understanding the VIX: The Fear Gauge of the Market

The VIX, or the CBOE Volatility Index, is often referred to as the market’s “fear gauge.” It measures the market’s expectations of near-term volatility, derived from the implied volatility of S&P 500 index options. A rising VIX typically indicates that investors expect increased volatility, often associated with uncertainty or market downturns, while a declining VIX signals lower expected volatility and greater market stability.

How the VIX is Calculated

The VIX is calculated using the prices of S&P 500 index options with approximately 30 days to expiration. It blends the implied volatilities of both call and put options across a range of strike prices. The formula uses a weighted average of these option prices to estimate the market’s expected volatility. Higher option prices reflect greater uncertainty, resulting in a higher VIX value. The calculation is designed to provide a snapshot of expected market volatility over the next month.

Implied Volatility Formula (Simplified)

Implied volatility itself is not something you can calculate directly with a simple formula. Instead, it’s backed out from option prices using a model like the Black-Scholes formula. Implied volatility is the σ value that makes the formula equal the actual option price in the market. It’s found using trial and error (numerical methods).

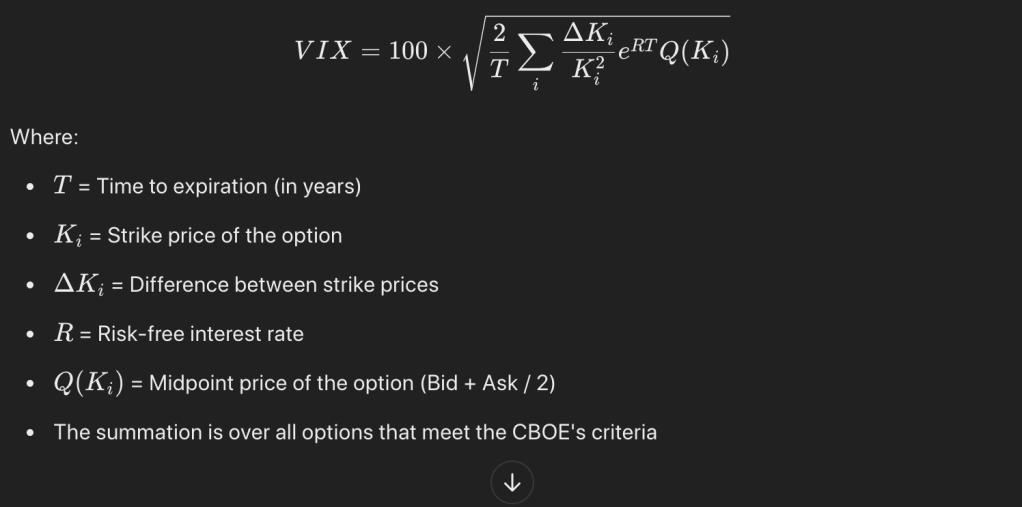

VIX Formula (Official CBOE Method)

The VIX is calculated using a weighted average of implied volatilities from a wide range of S&P 500 index options — both calls and puts — with expiration dates around 30 days out.

How Traders Use the VIX

Traders and investors use the VIX as a barometer of market sentiment. When the VIX is high, it signals fear and uncertainty, which often correlates with falling stock prices. Conversely, a low VIX suggests complacency and stable markets. Some traders use the VIX as a contrarian indicator—buying stocks when the VIX is high and selling when the VIX is low. Others use the VIX to hedge portfolios, as volatility spikes can cushion losses in equities.

Investing in the VIX

Although the VIX itself is not directly investable, there are financial instruments designed to track its movements. The most common ways to gain exposure to the VIX are through VIX futures contracts or exchange-traded products (ETPs).

VXX and VXZ

Two popular VIX-related ETPs are the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the iPath Series B S&P 500 VIX Mid-Term Futures ETN (VXZ).

- VXX: VXX provides exposure to short-term VIX futures contracts, which typically have higher sensitivity to near-term volatility changes. It is often used by traders seeking to capitalize on short-term market fear or to hedge against sudden market downturns. However, due to the nature of futures roll costs (known as contango), VXX tends to lose value over time in calm markets.

- VXZ: VXZ offers exposure to mid-term VIX futures contracts, which are less sensitive to short-term market fluctuations but more stable over longer periods. VXZ is often used as a longer-term hedge against market volatility, though it is still subject to roll costs.