The Company

UiPath, Inc. (ticker: PATH) is a leading enterprise automation software company focused on robotic process automation (RPA) and, more recently, “agentic” AI-driven automation. Its platform lets organizations design, orchestrate, and run software robots and AI agents that mimic human interactions with digital systems, automating repetitive front- and back-office workflows across finance, HR, IT, operations, and customer service. The company began in Romania and is now headquartered in New York, serving thousands of customers worldwide.

Financials

Scale and growth

- Fiscal year 2025 (ended Jan 31, 2025) revenue was $1.43 billion, up 9% year-over-year. UiPath, Inc.

- Annualized recurring revenue (ARR) reached $1.666 billion, growing 14% year-over-year, reflecting a high mix of subscription and license contracts. UiPath, Inc.

Profitability and margins

- FY25 GAAP gross margin was 83%, with non-GAAP gross margin of 85%, consistent with high-margin enterprise software. UiPath, Inc.

- UiPath reported a GAAP operating loss of $(163)M, but non-GAAP operating income of $241M, indicating underlying profitability once stock-based compensation and other non-cash/non-recurring items are excluded. UiPath, Inc.

Cash flow and balance sheet

- FY25 operating cash flow was $321M, with non-GAAP adjusted free cash flow of $328M, showing good cash conversion. UiPath, Inc.

- As of Jan 31, 2025, UiPath held ~$1.7B in cash, cash equivalents, and marketable securities, giving it a strong net cash position and flexibility for R&D and acquisitions (such as the 2025 acquisition of Peak AI). UiPath, Inc.+1

Revenue mix (high level)

UiPath discloses revenue by category as licenses, subscription services, and professional services & other. In the FY2024 10-K (latest detailed mix), these represented approximately:

- Licenses: 47% of revenue

- Subscription services: 50% of revenue

- Professional services & other: 3% of revenue UiPath, Inc.

This indicates a predominantly software and recurring-revenue profile, with services a small (but strategic) component to drive adoption.

TAM / CAGR

UiPath’s addressable market spans RPA, intelligent process automation, and broader intelligent/agentic automation platforms. Estimates vary depending on scope, but recent third-party research suggests:

- The core RPA software market:

- ~$3.8–5B in 2024, projected to reach about $30.9B by 2030, implying a CAGR ~40–45% from 2025–2030. Grand View Research+1

- The broader intelligent automation market (combining RPA with AI, process mining, orchestration, etc.):

- Estimated at ~$13.8B in 2024, expected to grow to ~$115B by 2034, a CAGR of ~23–24%. Market.us+1

Putting this together, UiPath is operating in a rapidly growing automation/AI software market with a likely TAM in the tens of billions of dollars today and growth expectations in the low-20s to 40%+ CAGR range over the next decade, depending on how broadly you define its market (pure RPA vs. full intelligent/agentic automation platforms).

Products

At a high level, UiPath delivers an integrated automation platform plus cloud services and a small services layer.

| Product / Service Category | What It Includes | Approx. % of Revenue* |

|---|---|---|

| Licenses (Platform & Robots) | Term/per-user/per-capacity licenses for the UiPath Platform: Studio/StudioX, Robots, Orchestrator, and newer agentic tools like Autopilot, Agent Builder, and Agentic Orchestration. | ~47% |

| Subscription Services & Support | Cloud-delivered Automation Cloud, Agentic Testing/Test Cloud, support & maintenance, and other recurring SaaS/consumption offerings under Unified/Flex pricing plans. | ~50% |

| Professional Services & Other | Implementation, consulting, training, and related services to help customers deploy, manage, and scale UiPath automations. | ~3% |

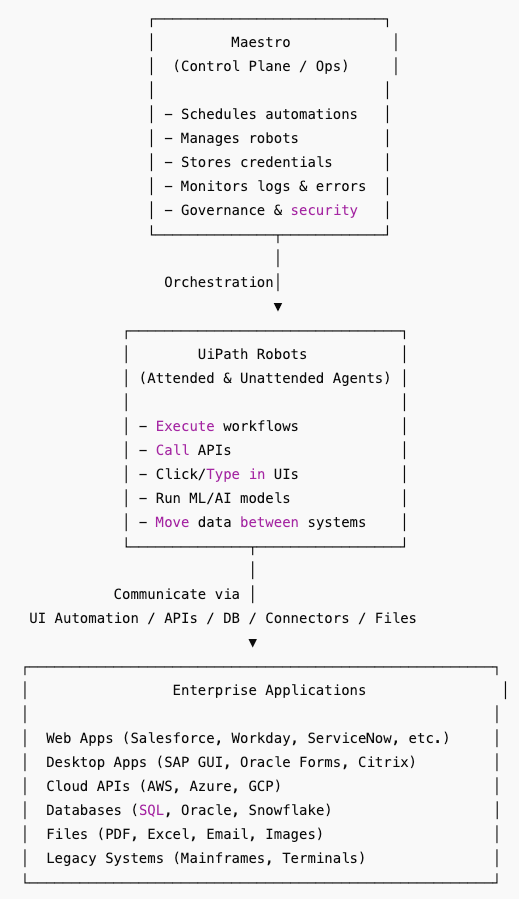

In addition to core RPA tools, UiPath has been aggressively pushing into agentic AI: Autopilot (AI-assisted development and operations), Agent Builder (build custom AI agents), Maestro (orchestration), Test Cloud, and related offerings aimed at extending automation from rule-based bots to more autonomous, AI-driven workflows.

Business Model

UiPath operates a high-margin enterprise software model with several key characteristics:

- Subscription and term-license revenue:

The vast majority of revenue is subscription-like — time-bound licenses, cloud subscriptions, and support contracts that contribute to ARR. UiPath, Inc.+1 - Commercial plans (Unified & Flex):

UiPath offers Unified Pricing and Flex plans that bundle platform, robot, and user licenses, often metered by user type, capacity, or consumption units. Service licenses can be tied to usage metrics (instances, capacity, or consumption units). UiPath Documentation Portal+2UiPath Documentation Portal+2 - Enterprise-driven sales motion:

Revenue is primarily generated through direct sales to large enterprises, supplemented by a global partner ecosystem (consultancies, system integrators, BPOs) that implement and manage UiPath deployments. - High recurring revenue and land-and-expand:

The business focuses on ARR growth, with dollar-based net retention historically above 100% (110% in FY25), indicating expansion within existing customers through additional use cases, robots, and AI agents. UiPath, Inc. - Ecosystem and training flywheel:

UiPath supports a large developer and partner community and runs UiPath Academy for free RPA/automation training and certification, which helps entrench the platform as a de-facto standard in many organizations. Wikipedia+1

Customers

UiPath’s customer base is global, diversified, and skewed to large enterprises, including sectors such as:

- Financial services and insurance

- Healthcare and life sciences

- Manufacturing and supply chain/logistics

- Telecom, technology, and shared services/BPO

- Public sector and utilities UiPath, Inc.+1

Examples of named customers using UiPath automation include Uber, Generali, and logistics group Expo Group, among many others. UiPath+2UiPath+2

The company notes that a substantial portion of revenue and ARR comes from its top 10% of customers, which means individual large accounts can materially influence results, but also shows strong entrenchment among major enterprises. SEC

Competitors

UiPath competes in a crowded but relatively consolidated enterprise automation/RPA space. The top three competitors with directly competing platforms are:

- Automation Anywhere

- A pure-play enterprise RPA platform provider.

- Competes directly on large, complex automation deployments, document processing, and AI-enhanced automation. Reuters+2Zoho+2

- Microsoft Power Automate

- Part of the Microsoft Power Platform, integrated with Microsoft 365 and Azure.

- Competes on workflow automation and RPA, often winning in organizations already standardized on Microsoft’s stack, with pricing and bundling advantages. Zoho+2Multimodal+2

- SS&C Blue Prism (Blue Prism Intelligent Automation Platform)

- An RPA and intelligent automation platform with strong positioning in regulated industries (finance, insurance, public sector).

- Competes on governance, security, and large-scale, centralized automation programs. Zoho+2G2 Learn+2

Other notable rivals and alternatives include WorkFusion, IBM RPA, Appian, Zoho RPA, Testsigma, and various low-code and iPaaS tools that overlap with parts of UiPath’s use-case surface. Zoho+2Testsigma Agentic Test Automation Tool+2

Founding History

- Origins (DeskOver):

UiPath traces its roots to DeskOver, a small software outsourcing and automation-library business founded in 2005 in Bucharest, Romania by Daniel Dines and Marius Tîrcă. DeskOver initially built automation libraries and SDKs used by larger tech firms. VX Associates+2B Strategy Hub+2 - Shift to RPA and rebrand:

In 2013, the company released its first desktop automation product, evolving from a services shop into a product company for RPA. In 2015, it rebranded as UiPath, pivoting fully into RPA and opening offices in London, New York, Bangalore, Paris, Singapore, Washington D.C., and Tokyo. Seedcamp+2Wikipedia+2 - Global expansion and unicorn status:

Rapid enterprise adoption and a growing developer community helped UiPath scale to thousands of customers and a valuation exceeding $1B (Romania’s first “unicorn”). The company later moved its headquarters to New York to be closer to its global customer base. Business Review+1 - IPO and beyond:

UiPath went public on the New York Stock Exchange in April 2021, raising about $1.3B in one of the largest U.S. software IPOs at the time. Seedcamp+2Stockrow+2

Since then, UiPath has continued to expand its platform via organic R&D and acquisitions (e.g., Cloud Elements for API automation, Re:infer for NLP, and Peak AI in 2025 for agentic AI in retail and manufacturing), reflecting its strategy to evolve from RPA into a broader agentic automation platform.