The Company

Applied Optoelectronics designs, manufactures and sells fiber‑optic components and transceivers used in data communications, cable TV systems, fiber‑to‑the‑home and telecommunications networks.

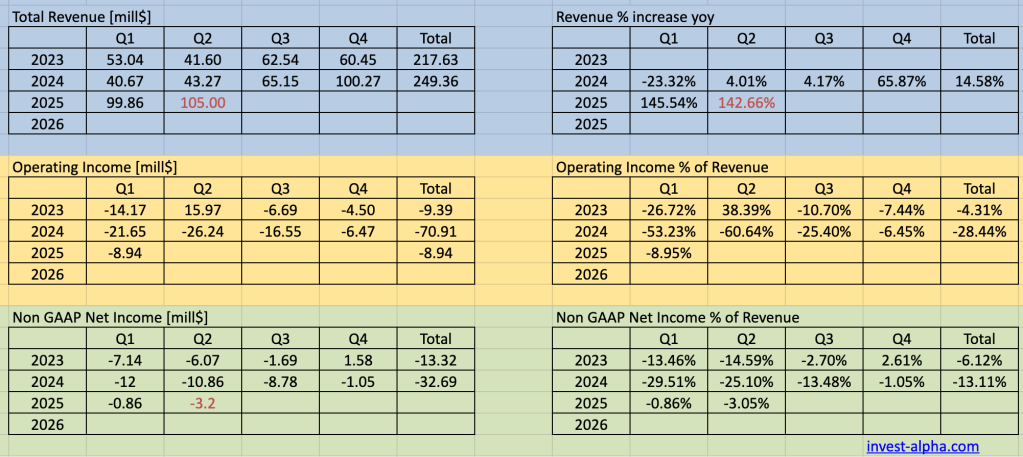

Financials

TAM / CAGR

The global fiber‑optic transceiver market is currently estimated at $10 billion+, with forecasts predicting a CAGR of ~8–10% over the next several years, driven by AI infrastructure build‑out, hyperscale data centers, and shifts to higher‑speed optics

Products

| Product Segment | Description | % of 2024 Revenue |

|---|---|---|

| Data Center Transceivers | Optical modules for hyperscale server/switches | 60% (~$149 M) |

| Cable TV / Broadband | Lasers, transmitters, amplifiers via MSOs | 35% (~$87.7 M) |

| Telecom & Other | Traditional telecom optics, Fiber-to-the-home, Q etc |

Based on 2024 revenue mix data

Business Model

AAOI builds optical transceivers, subassemblies (light engines), and packaged solutions using in-house laser tech. It sells both B2B to OEMs and directly to cable multiple-system operators under its Quantum Bandwidth™ brand. Revenue scales with volume in data‑centers and cable upgrades; margins benefit from proprietary manufacturing and rising automation.

Customers

Key clients include hyperscale cloud providers like Microsoft, Amazon, Oracle, and major cable operators/MSOs. These customers are deploying 400G and 800G link upgrades in data-center and cable networks

Competitors

Top 3 direct competitors in the fiber‑optic transceiver space:

- Lumentum Holdings – offers datacenter and telecom optics

- Ciena – broad portfolio including high-speed transceivers

- Infinera – specialist in packet-optical and transceiver modules

Founding History

Founded in 1997 and headquartered in Sugar Land, Texas, AAOI went public via IPO in March 2014 (raised ~2.7 M shares). Its CEO and founder, Dr. Thompson Lin, has overseen a strategic pivot from cable-optic components to high-speed data-center transceivers with laser integration capabilities