The Company

Credo Technology Group Holding Ltd specializes in high-speed connectivity solutions for data centers, enterprise networking, and telecommunications. The company focuses on delivering Serializer/Deserializer (SerDes) technology and active electrical cables (AECs) that enhance data transmission efficiency and performance.

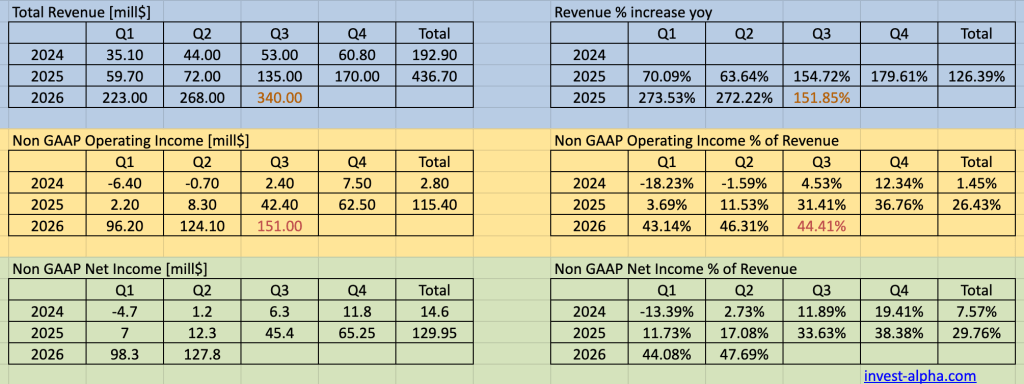

Financials

Bull Case

- Credo is the market leader in Active Electrical Cables (AEC) and ReTimers used in AECs for intra rack connections in AI servers. They are seeing massive tailwinds with the AI infrastructure build out. Latest Q2 revenue grew 270% yoy.

- 4 hyperscalers contributed more than 10% of total revenue with a 5th starting to ramp up.

- Business is very profitable with an Operating Income margin of around 45% giving it a Rule of 40 score in excess of 250.

- Credo is expanding it’s connectivity product lines through 3 new next gen connectivity solutions that are extending the reach of their products while improving reliability and power : 1) Zero-FLAP AECs 2) Active LED Cables and 3) Omniconnect gearboxes for lowering costs of memory. Management expects these to significantly expand the TAM by as much as 10Bill$ in years to come. This is 10X of 2026 revenues.

Management Outlook Q2 2026

- AECs are the fastest growing segment. AECs have become the de facto standard for inter-rack connectivity and are now displacing optical rack-to-rack connections up to 7 meters. At 100 gig per lane today and 200 gig per lane tomorrow, zero-flap AECs deliver up to 1,000 times better reliability than traditional laser-based optical modules, while consuming roughly half the power.

- Four hyperscalers each contributed more than 10% of total revenue, and a fifth started contributing initial revenue

- Our IC business, which includes retimers and optical DSPs, also continued with strong performance. We expect significant optical DSP growth in fiscal 2026, driven by 50 gig and 100 gig per lane deployments, with longer-term growth driven by our 200 gig per lane solutions. Live demonstrations last quarter of our 200 gig per lane Bluebird optical DSP drew significant interest and extremely positive feedback.

- We’ve added three entirely new growth pillars, each representing distinct multi-billion dollar market opportunities that significantly expand our total addressable market and extend the reach and depth of our connectivity leadership:

- 1) The first new growth pillar is Zero-flap Optics, the first laser-based optical connectivity family that delivers AEC-class network reliability. Our ZF Optics solutions expand our addressable market to any length of connection within the data center. We anticipate initial revenue in fiscal 2027 and long-term a market that will be a multi-billion dollar opportunity. Our ZF Optics solutions expand our addressable market to any length of connection within the data center.

- 2) Active LED Cables (ALC) – Credo has combined forces with Ottawa-based Hyperloom, a team of experts specializing in high-performance micro-LED technology. Credo has been investing in micro-LED innovation over the past 18 months with the intent of developing a new class of connectivity solutions. As a first product, we’ll develop and bring to market a pluggable optical solution that utilizes micro-LEDs as the light source. Our same three-tiered innovation playbook will be the catalyst to pioneering this entirely new connectivity category we call active LED cables, or ALCs. ALCs will deliver the same reliability and power profile as an AEC, but in a thin gauge cable that can reach up to 30 meters and is ideal for row scale scale-up networks. Customer reaction has been very positive. We plan to sample the first ALC products to lead customers during our fiscal 2027, with initial revenue ramping in fiscal 2028. We believe the ALC TAM will ultimately be more than double the size of the AEC TAM.

- 3) Omniconnect gearboxes – the third new pillar of long-term revenue growth, a family of products that will enable a disaggregated and optimized approach to XPU connectivity. Today’s on-package high bandwidth memory is capacity and throughput limited, as well as expensive and supply chain constrained. Weaver allows designers to move to commodity DDR memory and achieve up to 30 times more memory capacity and eight times the bandwidth. OmniConnect family, it is a copper solution, but it’s redefining how memory-to-compute or memory-to-XPU connectivity is done.

TAM / CAGR

The global high-speed data center connectivity market, where Credo operates, is projected to reach approximately $20 billion by 2028, with a Compound Annual Growth Rate (CAGR) of around 10% over the next five years.

Products

| Product Category | Estimated Description | Estimated % of Total Revenue |

|---|---|---|

| AECs (Active Electrical Cables) | High-performance copper-based cables for intra rack AI high bandwidth connections; market leader with dominant share | ~50–60% (of total revenue)* |

| Retimers (PCIe/Ethernet) | DSP Chips for extending signal integrity in AI systems | ~20–30% |

| Optical Connectivity | System-level optical DSPs offering power-efficient, reliable solutions | ~10–15% |

| Other ICs / Integrated Circuits | Miscellaneous chip products / legacy offerings | ~1–5% |

| IP Licensing | SerDes IP licensing revenue | ~2.7% |

| Zero Flap AECs | laser-based optical connectivity family that delivers AEC-class network reliability. | New product line expected to bring revenue in 2027, 2028 onward |

| Active LED Cables | pluggable optical solution that utilizes micro-LEDs will deliver the same reliability and power profile as an AEC, but in a thin gauge cable that can reach up to 30 meters | New product line expected to bring revenue in 2027, 2028 onward |

| Omniconnect gearboxes | allows designers to move to commodity DDR memory and achieve up to 30 times more memory capacity and eight times the bandwidth. | New product line expected to bring revenue in 2027, 2028 onward |

Next Gen Products

1. Zero-FLAP AECs (Active Electrical Cables)

What it is:

Next-gen copper cables with embedded DSPs that require no link training (“Zero-FLAP”), enabling deterministic, plug-and-play 400G/800G/1.6T intra-rack connections.

Main benefit:

➡ Up to 1000× greater reliability and ~50% lower power than optical modules for short-reach AI rack links, with instant link bring-up and no flaps.

Revenue timing:

➡ Shipping now, scaling through 2025–2027 as 800G and 1.6T AI racks proliferate.

This is Credo’s strongest near-term growth driver.

2. ALCs (Active Linear Cables)

What it is:

A lower-cost, lower-power alternative to AECs where the cable contains no retimer, only linear amplification—used for very short AI rack connections.

Main benefit:

➡ Lowest-power, lowest-cost copper interconnect for hyperscalers looking to reduce power budgets across tens of thousands of links.

Revenue timing:

➡ Sampling now, expected volume ramp in CY2025, especially for hyperscaler AI racks that prefer linear vs. retimed designs for specific topologies.

3. OmniConnect (System-level AI connectivity platform)

What it is:

A new standards-based chiplet + connectivity fabric designed to interconnect CPU, GPU, NPU, DPU, and memory subsystems with low-latency, energy-efficient die-to-die interfaces — aimed at next-gen heterogeneous AI compute.

Main benefit:

➡ Provides unified, vendor-agnostic chip-to-chip connectivity, competing with proprietary Nvidia/AMD interconnects and aligning with the open-chiplet (UCIe) trend.

Revenue timing:

➡ Earliest revenue around late 2026–2027, as it must be designed into next-generation AI/accelerator chips; could become a multi-hundred-million-dollar franchise if chiplet adoption accelerates.

Reference

What AECs (Active Electrical Cables) are

- They are copper-based high-speed data cables with integrated electronics (“active” components like equalizers and retimers).

- The electronics compensate for signal loss and distortion that normally happens when you push very high data rates over copper.

- They are designed for short-reach of upto 5m, high-bandwidth connections 800G, typically for intra rack connections. The next generation AEC speeds are expected to reach 1.6T.

- They consist of multiple serial lanes typically where each lane is capable of 50 / 100 / 200 Giga Bits per second data transfers.

- AECs are used for Switch->GPU server, GPU->GPU over ethernet, TOR->NIC connections.

- Copper based cables consume less power than optical ones.

Where AECs are used

- Server-to-server connections within a rack or across racks in the same row.

- Switch-to-switch or switch-to-server connections in data centers, especially in AI and cloud infrastructure where GPUs and CPUs need massive bandwidth.

- Common in hyperscale data centers (Amazon, Microsoft, Google, Meta, etc.) and increasingly in AI clusters like those built with NVIDIA GPUs.

What a Retimer is

- A retimer is a specialized chip that cleans up and restores high-speed digital signals as they travel across a circuit board or a cable.

- At very high data rates (like PCIe Gen5/Gen6 or 400G/800G Ethernet), signals degrade quickly due to noise, loss, and jitter.

- A retimer receives the degraded signal, reconstructs it (“re-times” it), and transmits it again as if it were brand new.

Where Retimers are used

- Inside servers: To ensure reliable connections between CPUs, GPUs, NICs, and accelerators over PCIe.

- On AI/ML accelerator boards: Retimers enable GPUs (e.g., NVIDIA H100, B200) to communicate at full PCIe speed across longer distances than would otherwise be possible.

- In networking equipment: Used in Ethernet switches and routers for long, high-speed board traces.

- With cables (AECs or optics): Sometimes paired with AECs or optical transceivers for clean high-speed links.

Customers

Credo’s major customers include leading hyperscale cloud providers such as Microsoft, Amazon, and Oracle. These companies utilize Credo’s high-speed connectivity solutions to enhance their data center operations and support AI deployments.

Four hyperscalers each contributed more than 10% of total revenue, and a fifth started contributing initial revenue

Competitors

Credo’s top competitors in the semiconductor connectivity market include:

- Marvell Technology (MRVL): Offers high-speed data center interconnect solutions.

- Advanced Micro Devices (AMD): Provides data center and networking connectivity products.

- Broadcom (AVGO): Develops semiconductor solutions for data center networking.

AEC Competitive Landscape

Competitor Table — AEC

| Vendor | 400G | 800G | 1.6T | Zero-FLAP equivalent? | Notes |

|---|---|---|---|---|---|

| Credo (CRDO) | ✔ Shipping | ✔ Shipping | ✔ Sampling | ✔ Yes — unique market feature | Market leader; merchant silicon for cables |

| Broadcom | ✔ Shipping | ✔ Limited merchant; mostly captive | ✔ Sampling (switch-side DSP) | ✖ None | Primarily used in Broadcom-enabled copper cables; few external customers |

| Marvell | ✔ Shipping | ✔ Shipping | ✔ Early samples | ✖ None | Strong in DSP PHY, but no Zero-FLAP equivalent |

| Astera Labs (ALAB) | ✔ Via active copper / retimer | ✔ Some support via PCIe/CEC PHY | ✖ Not announced | ✖ None | Focus more on AI optical (AOC/ACC), not AEC |

| Luxshare / Amphenol | ✔ With Credo silicon | ✔ With Credo silicon | ✔ With Credo silicon | ✔ With Credo silicon | They are cable manufacturers that use Credo DSP |

Competitor Table — AEC / Cable Retimer DSPs

| Vendor | 400G | 800G | 1.6T | Zero-FLAP Equivalent | Market Position | Notes |

|---|---|---|---|---|---|---|

| Credo (CRDO) | ✔ Shipping | ✔ Shipping | ✔ Sampling | ✔ Yes | Market leader | Only merchant supplier with Zero-FLAP AEC; mass adoption in AI racks |

| Broadcom | ✔ | ✔ (captive) | ✔ Internal | ✖ | Strong but captive | Mostly used with Broadcom switch/NIC ecosystems |

| Marvell | ✔ | ✔ | ✔ Sampling | ✖ | Growing | Competes in merchant market but behind Credo |

| Astera Labs | ✖ | ✖ | ✖ | ✖ | None | Not in AEC space; focuses on PCIe/CXL |

| Cable OEMs (Luxshare, Amphenol) | Use Credo chips | Use Credo chips | Future | ✖ | Manufacturing only | They do not make retimers; they buy from Credo/Marvell |

Main Investors

| Investor |

|---|

| BlackRock |

| Walden International |

| Herald Investment Management |

Founding History

Credo was founded in 2008 by Job Lam and Lawrence Cheng. The company is headquartered in San Jose, California, and has grown to employ approximately 500 individuals.