The Company

IREN Limited (formerly Iris Energy) is a developer, owner and operator of high-performance, purpose-built data centers and an AI cloud platform focused on GPU-dense computing. The company pivoted from large-scale renewable-powered Bitcoin mining to build and operate AI Cloud GPU clusters, colocation and build-to-suit facilities — marketing its assets as vertically integrated, power-secure, high-density campuses designed for training and inference workloads. IREN uses 100% renewable energy for it’s data centers.

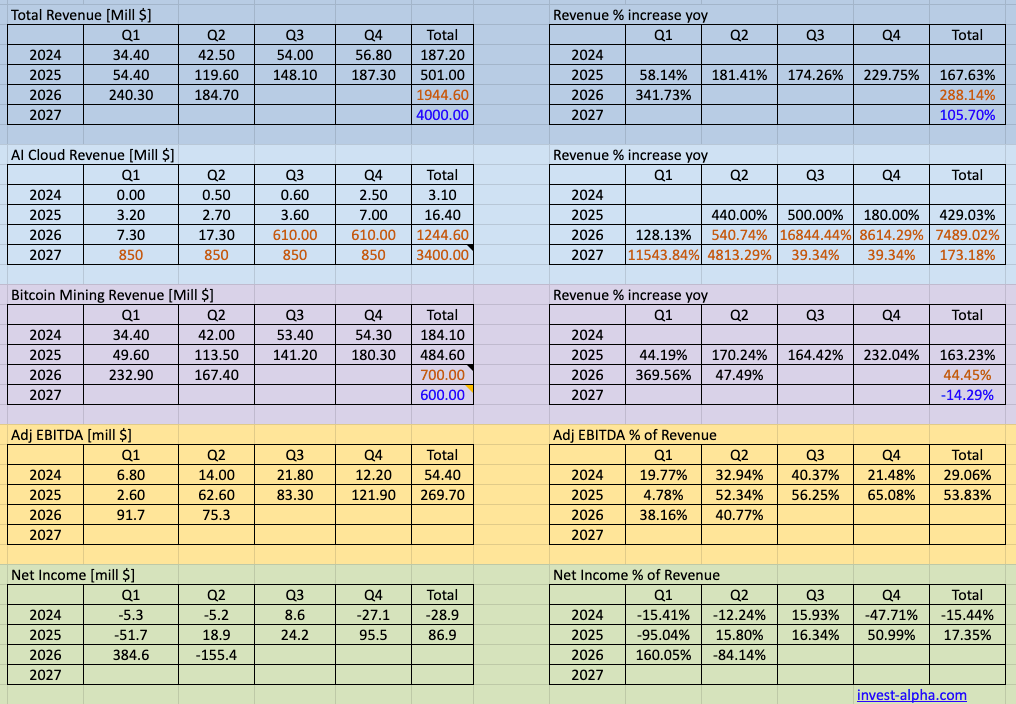

Financials

Bull Case

- Rapid growth – Management projecting rapid acceleration of Cloud ARR from 16 Mill$ in 2025 to 3.6 Bill $ by the end of 2026.

- Hyperscaler validation – 5 year 9.7 Bill $ contract with Microsoft.

- Good profitability – The EBITDA profitability for the Microsoft contract is projected to be 85%. Would suggest very efficient business where net income % might be high around 50%.

- IRIS has already secured 3GW of power and only 0.46 GW is currently in use. This can be a big advantage to be able to build out new infrastructure.

- IRIS is vertically integrated, owns it’s sites, power and therefore has more control on buildouts, operational efficiencies.

Bear Case

- There is a general concern with all the neo clouds that the capacity that is being leased out by the Hyperscalers may be temporary and a hedge by the larger players to not overspend on Capex.

Bookings

| Announcement date | Customer name | GPUs / capacity booked (if disclosed) | Revenue / ARR disclosed | Contract duration (term) | Start date (actual / expected) | Notes |

|---|---|---|---|---|---|---|

| Nov 3 2025 | Msft | NVIDIA GB300 GPUs | 9.7 Bill $ | 5 years | in phases through 2026 at Childress Texas | https://iren.gcs-web.com/static-files/0aea9298-ac5b-4a57-9615-5a2298010a88 |

| Oct 7, 2025 | Various — unnamed “leading AI companies” | ~23,000 GPUs | ~$500 million AI Cloud ARR | By end of Q1 2026 | ||

| Feb 15, 2024, April 8 | Poolside AI SAS | 248 NVIDIA H100, then increased in April | Not disclosed | Initial 3 months, extension option +3 months at customer’s election. | Contract/ service commenced ~5 Feb 2024 (company states cloud service commenced in early Feb 2024). | First named AI customer disclosed by IREN (then Iris Energy) after pivot to AI cloud; contract followed customer testing and selection. |

TAM / CAGR

IREN addresses the AI infrastructure / GPU cloud and high-performance data center markets. Selected market estimates for context:

- Global AI infrastructure market (recent estimates): on the order of tens–low hundreds of billions USD today — e.g., MarketsandMarkets / related industry reports show the AI infrastructure market measured in the low-to-mid hundreds of billions in near-term projections (strong multi-year growth).

- Cloud AI / AI cloud market CAGR: multiple market reports estimate annual growth in the high-20s to 30s % range for “cloud AI” / AI infrastructure through the late 2020s (example forecasts: ~25–30%+ CAGR).

Products / Services

| Product / Service | What it is | Approx. % of FY25 consolidated revenue (est.) |

|---|---|---|

| Bitcoin mining (hardware + mined BTC revenue) | Revenue from mined BTC, mining services and related hardware economics (historical core business). | ~70–80% (majority of FY25 revenue). |

| AI Cloud (GPU cloud / bare-metal clusters) | IREN Cloud™ — bare-metal NVIDIA GPU clusters (H100/GB300/B300 families), InfiniBand networks, turnkey GPU cloud services for training & inference. | ~3–8% (early-stage but rapidly growing; management guidance targets materially larger ARR into FY26). |

| Colocation & hosting / build-to-suit | Power-dense colocation, rack space, and design/build projects for hyperscale or enterprise customers. | ~10–20% (includes hosting fees, facility services and gating revenue). |

| Other / services & commercial | Professional services, network services, ancillary commercial offerings. | ~1–5%. |

Datacenter sites

Planned compute

| Year | # of GPUs | GW required | ARR Bill $ that it can support | EBITDA Bill$ (85%) | Net Inc Bill$ (50%) |

| end 2025 | 23000 | ||||

| end 2026 | 140000 | 0.48 | 3.4 | 2.89 | 1.70 |

Business model

- Asset-backed, hybrid model: IREN monetizes large, vertically integrated physical assets (land, substations, grid interconnections and purpose-built halls) through (a) Bitcoin mining operations and (b) a strategic pivot to sell GPU compute capacity (AI Cloud, colocation, build-to-suit).

- Power & GPU supply advantages: the company’s core moat is access to secured, low-cost grid power at scale and relationships / GPU purchase commitments (e.g., large NVIDIA orders and preferred partner status) that help it densify facilities faster than greenfield entrants. These allow IREN to offer competitive pricing for GPU hours and accelerate time-to-market for customers.

- Revenue mix & hedging: legacy mining provides near-term cash generation while management leverages that cash to fund GPU purchases and facility build-outs; AI Cloud typically yields higher hardware profit margins (management reported very high hardware profit margins on GPU cloud revenue).

Customers

- Large AI labs / model developers and companies needing burst or baseline GPU capacity (training / fine-tuning).

- Enterprises & research organizations that require bare-metal GPU clusters (bring-your-own-software / BYO frameworks).

- Colocation and hyperscale customers seeking build-to-suit, power-dense halls.

- Wholesale customers and channel partners who take committed racks / capacity under multi-year contracts (IREN has recently disclosed multi-year AI cloud contracts).

Competitors

- NVIDIA / NVIDIA Cloud Partners (e.g., CoreWeave, Lambda) — companies like CoreWeave and Lambda operate GPU-native cloud offerings (bare-metal and managed GPU clusters) that directly compete with IREN’s AI Cloud services for training/inference workloads and enterprise GPU demand. These providers offer GPU rental, managed stacks and developer ecosystems tailored to ML workloads.

- Hyperscale cloud providers (AWS, Microsoft Azure, Google Cloud) — their GPU instances and specialized AI infrastructure (e.g., AWS Trainium/GPU instances, Azure ND & NVA families, Google Cloud’s A3/TPU offerings) compete on scale, global availability and integrated cloud services; customers trade off IREN’s cost/latency/power characteristics versus hyperscaler platform benefits.

- Specialist AI infrastructure operators / colo players (e.g., Equinix Metal, Digital Realty and other GPU-focused colo providers) — these firms offer high-density colocation, interconnectivity and build-to-suit solutions that overlap with IREN’s colocation and build-to-suit offerings for customers requiring custom, power-dense facilities.

Founding history

IREN began as Iris Energy, an ASX/Nasdaq-listed Bitcoin miner focused on renewable-powered mining sites. As the market for large-scale GPU compute surged, management pivoted the company’s strategy to repurpose and expand its low-cost, grid-connected data center footprint into AI Cloud, colocation and build-to-suit offerings — leveraging secured power, land and mining cashflows to accelerate GPU purchases and facility upgrades. The rebrand and strategic pivot positioned IREN as a hybrid operator bridging crypto mining cash generation with a fast-scaling AI infrastructure business.