The Company

AeroVironment, Inc. (AVAV) is a U.S.-based technology company that primarily designs and manufactures unmanned aerial vehicles (UAVs), tactical missile systems, and advanced electric vehicle charging systems. Its core business focuses on small, hand-launched UAVs, which are used for surveillance, reconnaissance, and intelligence gathering. Notable products include the RQ-11 Raven, RQ-20 Puma, and Switchblade, which are widely used by the U.S. military and other defense forces around the world.

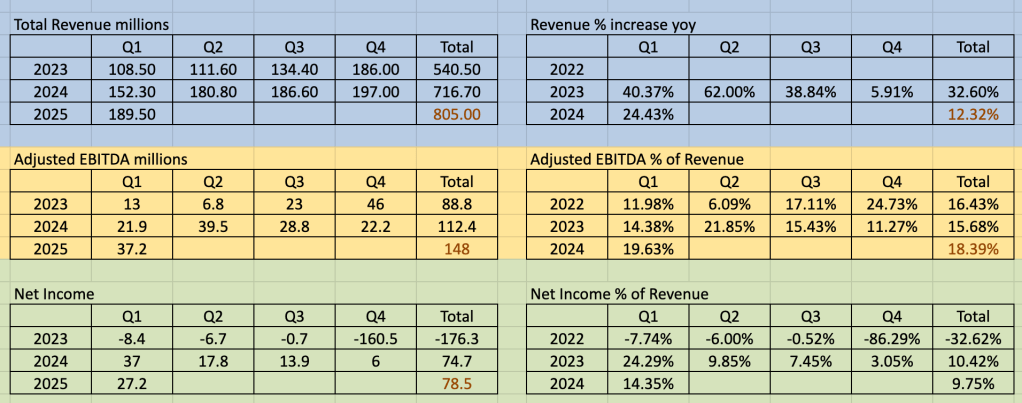

Financials

TAM, CAGR

The total addressable market (TAM) for military drones is projected to grow significantly over the next few years. As of 2023, the market was valued at around $14 billion, and it’s expected to reach $28.84 billion by 2032, with a compound annual growth rate (CAGR) of about 7.5%

Product Categories

UxS – Uncrewed Systems

LMS – Loitering Munition Systems – Switchblades, Blackwing

Revenue by Product Segment –

1Q 2025 Earnings Call Highlights

Positives

Regarding LMS product line

“we’re now starting to book key Switchblade opportunities such as our recent U.S. Army $1 billion IDIQ contract and anticipate funded backlog to increase in coming quarters.” – Switchblade is one of the products under the Loitering Munitions catgory.

“Just last week, we received a $128 million award under the U.S. Army’s directive requirement for lethal unmanned systems, which is not reflected in our first-quarter funded backlog. This award is the first task quarter that is part of a five-year sole source IDIQ contract with a ceiling value of nearly $1 billion.”

“LMS revenue grew 68%”, “LMS business is only at the beginning stages of this strong growth cycle, and we anticipate continued momentum beyond this fiscal year.”

Regarding UxS product line

“we anticipate booking additional Puma orders as part of the recently announced Ukraine aid package.”

Negatives

“For fiscal year 2025, the Company continues to expect revenue of between $790 million and $820 million, net income of between $74 million and $83 million, Non-GAAP adjusted EBITDA of between $143 million and $153 million, earnings per diluted share of between $2.61 and $2.92

and non-GAAP earnings per diluted share” – Given the potential U.S. Army $1 billion IDIQ contract, it was surprising to not get any change to the outlook.