The Company

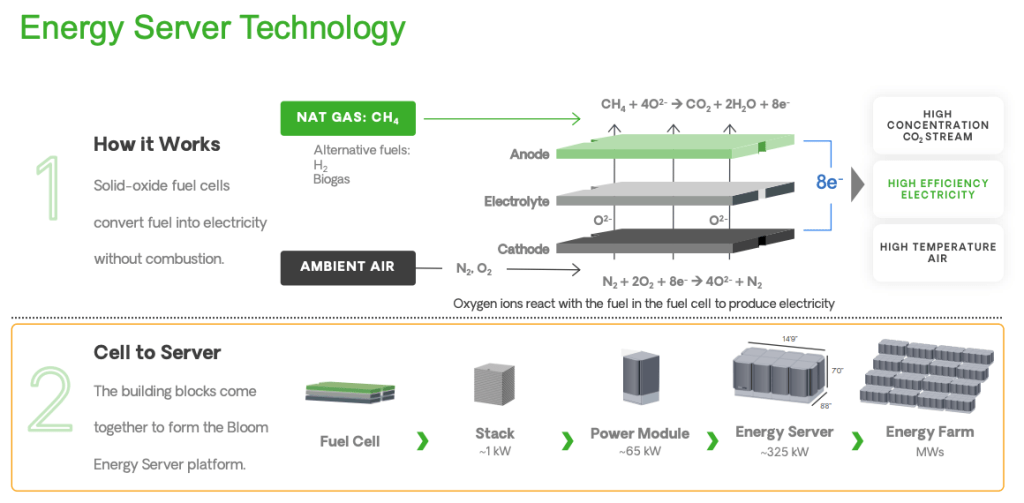

Bloom Energy designs, manufactures, sells and installs high-efficiency solid oxide fuel cell systems and related services for on-site power generation. Its core platform (the “Energy Server”) can convert natural gas, biogas, hydrogen or fuel blends into electricity through electrochemical processes rather than combustion, addressing commercial and industrial customers seeking lower-carbon, resilient, distributed power.

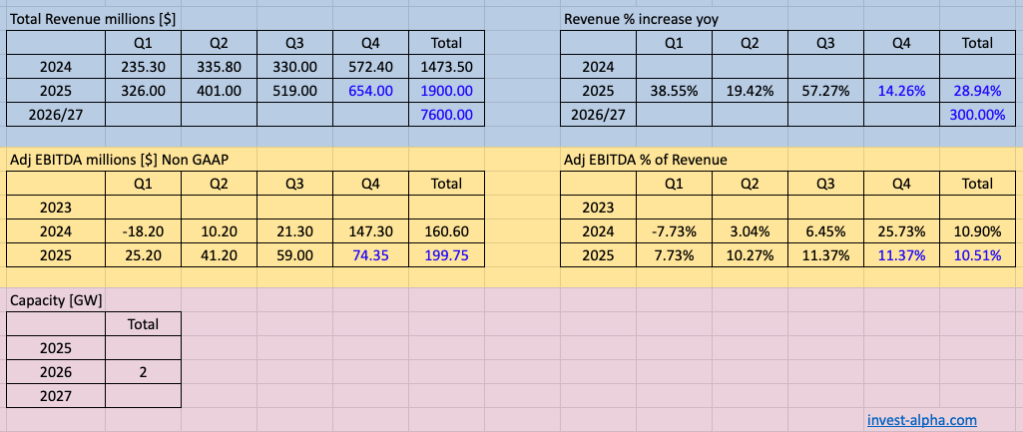

Financials

Bull Case

- Bloom Energy servers offer a few key advantages over gas turbines

- 1) they don’t require batteries

- 2) provide continuous DC power directly at 400 / 800V for the AI Racks. Gas Turbines produce AC power that requires stepping down and conversion to DC.

- 3) require less maintenance due to lack of mechanical parts. Gas Turbines are known to have several hours of downtimes.

- Management hinted at a 4X of 2025 revenue potential with a rapid doubling of capacity to 2GW by end of 2026. Unclear if all of it will be realized in 2026 but hinting at acceleration.

- Able to supply onsite energy to customers within 90 days. This is very important as energy is the biggest roadblock for the rapid build out of AI infrastructure.

- Bloom Energy can scale faster than other energy providers who have supply chain constraints per management. In a race to enable more datacenters with energy, Bloom Energy should be able to pick up rapid market share for onsite energy.

- Brookfield one of the world’s largest infrastructure owners with over a trillion dollars in assets announced a 5 Bill $ investment in Bloom. Brookfield has assets that comprise of 140 data centers operating and using approximately one gigawatt of critical load capacity. On top of that, they have a portfolio of factories, commercial offices and real estate. That are all going to be beneficiaries of AI, and as they automate, as they bring robots in, those factories are going to need more power. So Brookfield is using their balance sheet and making Bloom the preferred partner for on site energy provision.

- Bloom Energy’s Fuel Cell architecture is scalable to power everything from small retail stores to massive AI data centers.

- The trend to transition from 400V to 800V AI Racks for next generation GPUs benefits Bloom Energy as their fuel cells are ready to support this.

Bear Case

- Bloom Energy Servers have a higher up front cost.

- Natural Gas based on site electricity generation may be a short term demand that may wane once grid is able to supply sufficient power through nuclear and other sources.

- Bloom’s Energy Servers may have performance issues previously not known with deploying a completely new technology. Gas Turbines on the other hand have a long history.

Management Outlook ( Q4 2025 )

- Bloom is becoming the standard for onsite energy.

- Product backlog grew 140%

- CNI backlog grew 135% – telecom, manufacturing, logistics, retail, education.

- Have secured supply chain and can meet hyperscaler demands without being a bottleneck within 90 days.

- Able to stay price competitive in low cost States where natural gas infrastructure is available.

Management Outlook ( Q3 2025 )

- The AI build-outs and their power demands are making on-site power generated by natural gas a necessity.

- Winning the AI race is a nation-state priority, driving government policy and removing barriers that had previously been headwinds for on-site power generation.

- Our fuel cells have seen double-digit year-over-year cost reductions. While our costs are coming down, our performance is going up.

- 100MW of on site power sold to telcos since 2011. AT&T, Verizon, TMobile are customers.

- Expanding to AI channels with a lead customer – 1) Hyperscalers with lead customer Oracle, 2) Electricity providers with lead customer AEP ( for AWS ) 3) Gas provider ( supplying a 3rd hyperscaler ) 4) Colocation provider with Equinix 5) Neocloud with Coreweave 6) Infra Funds –

- Brookfield has invested 5 Bill$ in Bloom. Bloom will be the preferred on-site provider for Brookfield’s trillion-dollar infrastructure portfolio of AI factories, data center operators, corporate facilities, and factories.

- Doubling our capacity to two gigawatts by December 2026, which will support about four times our 2025 revenue.

- We expect fiscal 2025 to be better than our previously stated annual guidance on our financial metrics.

Customer Contracts

Bloom Energy announced contract wins (including Q3 ’25 / Oracle)

| Customer / Partner | Announcement date (public) | Contract / capacity (as announced) | Revenue (disclosed) | Contract period — start | Contract period — end |

|---|---|---|---|---|---|

| Oracle (OCI) | Jul 24, 2025 | Deploy Bloom fuel cells at select Oracle Cloud Infrastructure (OCI) data centers in the U.S.; Bloom says it can deliver onsite power for an entire data center within 90 days. | Not disclosed. (Bloom did not give a $ figure in the press release or in Q3’25 materials.) | Deployments “within 90 days” of the announcement (Bloom statement). | Not disclosed. |

| SK ecoplant (SK Group) — preferred procurement / recommitment | Dec 22, 2023 (extension / recommitment referenced in filings) | Program to purchase up to 500 MW (recommitment / multi-year deliveries). | Bloom disclosed expected program revenue over time in investor materials (product + service estimates shown in SEC exhibits / press materials). Exact public $ recognition by quarter varies — where Bloom disclosed numbers I flagged them previously. | Delivery program began under prior PDA (2021) and deliveries extended through multi-year window (delivery term referenced through 2027 in filings/releases). | Service / revenue recognition discussed over 20-year service life in filings (product deliveries earlier; service revenues over long term). |

| Equinix | Feb 20, 2025 (and prior IBX agreements) | Expansion program to deploy Bloom systems to power data centers (Bloom referenced >100 MW across IBX facilities in disclosure/announcements). | Not disclosed (press announcements give MW scale but not a single contract $). | Ongoing; program builds on multi-year collaboration (no fixed public “end” date). | Not disclosed. |

| American Electric Power (AEP) for AWS | Jan 8 2026 ( prev Nov 14, 2024 announcement ) | 1GW @ Cheyenne WY | 2.65 Bill$ for hardware. Annual payment for services | end of 2026, early 2027 | 20 years upto 2047 |

| Brookfield (strategic AI infra partnership) | Oct 13, 2025 | Strategic partnership: Bloom named preferred onsite power for Brookfield’s AI data-center projects; up to $5B scale referenced in Brookfield announcement. | Up to $5.0B partnership scale cited by Brookfield/Bloom (descriptive — phased/conditional). | Partnership announced Oct 13, 2025; timing phased (first phases planned). | Not disclosed (multi-phase program; no fixed end date disclosed). |

| Major gas provider (unnamed) — will convert gas to electricity and sell on-site power to a third hyperscaler | Q3’25 earnings call Oct 28 2025 | ||||

| Coreweave at Illinois | Q3’25 earnings call Oct 28 2025 | ||||

| Brookfield European AI Inference data center | Q3’25 earnings call Oct 28 2025 |

Bloom Energy Contract Summary Table

| Customer | Contracted Power (GW) | Start Date (COD) | End Date | One-Time Hardware Revenue | Est. Annual Services Revenue |

|---|---|---|---|---|---|

| American Electric Power | ~1.0–1.1 GW | 2026–2027 | 2046–2047 | ~$2.65B (firm) | ~$80–120M |

| SK ecoplant (Korea) | ~0.5 GW | 2024–2025 | ~2044–2045 | ~$1.1–1.3B | ~$35–60M |

| Equinix | ~0.15–0.2 GW | 2023–2024 | ~2043–2044 | ~$350–450M | ~$12–20M |

| ~0.05–0.1 GW | 2022–2023 | ~2042–2043 | ~$120–250M | ~$4–10M | |

| AT&T | ~0.05 GW | 2022–2023 | ~2042–2043 | ~$100–130M | ~$3–6M |

| Apple | ~0.02–0.03 GW | 2018–2019 | ~2038–2039 | ~$40–70M | ~$1–3M |

| Multiple Hospitals / Campuses (US & Intl) | ~0.10–0.15 GW | 2021–2024 | Rolling | ~$250–350M | ~$8–15M |

TAM / CAGR

Bloom Energy plays in the stationary fuel cell / solid oxide fuel cell (SOFC) market and broader distributed power generation market. According to a recent industry report the global SOFC market is projected to grow from around US$2.98 billion in 2025 to about US$11.61 billion by 2030, implying a CAGR of roughly 31.2 % over that period.

Given broader adjacent markets (e.g., distributed generation, data-centre power, hydrogen‐enabled on-site generation) the company has cited multi-billion-to-trillion-dollar opportunity statements for longer-term horizons.

Hence Bloom Energy is addressing a niche but high-growth segment of the clean power/energy-transition market.

Products

| Product / Service | Description | Approximate % of Revenue* |

|---|---|---|

| Product (Energy Servers, Electrolyzers) | Sale of fuel cell systems, equipment hardware | ~73.9% |

| Service (operations, maintenance, service contracts) | Ongoing service, spare parts, long-term service agreements | ~13.6% |

| Installation | Related installation/redeployment of systems | ~9.3% |

| Electricity | Sale of electricity generated (on-site generation) | Remaining portion (~3-4%) |

Bloom Server versus Turbine Technology

| Category | Better | Why |

|---|---|---|

| Overall | Bloom | Best for quiet, low-emission continuous onsite baseload and resilience. |

| Electrical efficiency (steady-state / baseload) | Bloom | Higher electric efficiency at partial load and as a continuous source (esp. with heat recovery). |

| Peak/combined-cycle efficiency (large central plants) | Turbine | Combined-cycle turbines achieve the highest thermal-to-electric efficiency for large centralized plants. |

| Emissions & environmental performance | Bloom | Electrochemical process produces far lower NOₓ/particulates; better for strict emissions sites. |

| Startup time & transient response | Turbine | Aeroderivative turbines can reach high output faster once spooled; turbines have strong ramp capability for large blocks. |

| Need for batteries / short-duration smoothing | Bloom | Intrinsically steady output reduces need for batteries; turbines often require batteries for fast smoothing. |

| Fast, sub-second grid services / frequency regulation | Turbine + Battery | Turbines alone are slow; the combo (turbine + battery) is superior for sub-second and very fast services. |

| Reliability & mechanical simplicity | Bloom | Fewer moving parts → lower mechanical-failure modes and quieter operation. |

| Major maintenance / lifecycle outages | Bloom | No heavy rotating-machinery overhauls; maintenance is different but generally less disruptive mechanically. |

| Part-load performance | Bloom | Maintains efficiency at low/partial loads better than turbines. |

| Fuel flexibility (biogas, hydrogen blends) | Tie (contextual) | Bloom: good with biogas/hydrogen blends; Turbine: proven on a range of fuels and high power density—choice depends on fuel availability and concentration. |

| CapEx per kW (upfront) | Turbine | Simple-cycle turbines typically have lower upfront $/kW for peaking capacity. |

| OpEx & lifecycle economics (high capacity factor) | Bloom | Lower mechanical O&M and better economics when run 24/7 at high capacity factor. |

| Site footprint & install near load (urban/data center) | Bloom | Modular, low-noise, can be placed close to critical loads (behind-the-meter). |

| Noise, vibration, site friendliness | Bloom | Very quiet and low vibration compared with turbines. |

| Scalability to very large centralized plants | Turbine | Easier to scale to many 10s–100s of MW blocks economically. |

| Best for data centers / hospitals / critical behind-the-meter | Bloom | Provides clean, steady, resilient onsite power without noise/emissions issues. |

| Best for grid peaking / bulk dispatch / utility-scale | Turbine | Mature, high power density solution for peaking and large dispatch needs. |

| Integration with batteries for hybrid services | Turbine + Battery | Hybrid turbine+battery combinations are better for use cases needing both bulk and very fast response. |

| Capital recovery when used intermittently (low CF) | Turbine | Lower capex makes turbines less penalizing when capacity factor is low. |

| Capital recovery when used continuously (high CF) | Bloom | Higher capex amortized by continuous operation and lower O&M makes Bloom preferable. |

Business Model

Bloom Energy’s business model is two-fold. First, it sells or leases its Energy Server hardware to commercial/industrial customers who want on-site generation, often for reasons of reliability, resilience, carbon reduction or grid independence. Second, it provides long-term service and maintenance contracts, and in some cases sells electricity generated from its systems on a utility or power-purchase basis.

Typical hardware costs of hardware for customer is 2.5 Bill$ / GW

Annual service costs for customer is 100 Mill$ / GW. Customer is responsible for fuel costs while Bloom takes care of Stack replacement, Maintenance, Monitoring and Performance guarantees.

Customers

Bloom Energy targets commercial, industrial and utility-scale customers, including data centres, manufacturing facilities, utilities, microgrids and critical infrastructure operators. Its value proposition emphasises clean, reliable, on-site power. Many Fortune 100 companies and large-scale customers use its systems, reinforcing credibility and scale.

Competitors

Main competitors would be traditional gas turbine based solutions providers. But in the fuel cell market the direct competitors are :

- Plug Power Inc. – Offers fuel cell systems (especially hydrogen/PEM fuel cells) and electrolyzers for stationary and mobility applications; competes in clean‐power/fuel‐cell space.

- FuelCell Energy, Inc. – Develops and manufactures fuel cell power plants and hydrogen generation systems; overlaps in stationary fuel-cell power generation.

- Mitsubishi Hitachi Power Systems, Ltd. – Through its fuel-cell and hybrid turbine/FC systems, competes in large-scale stationary fuel cell and distributed generation markets.

These companies offer alternative fuel-cell or distributed power generation solutions and compete for similar customer segments, installations and services.

Founding History

Bloom Energy was founded in 2001 (initially under the name Ion America) by Dr. K. R. Sridhar and co-founders, with roots in NASA research and high-temperature fuel-cell technology. The company is headquartered in the San Jose, California area. Over the years it raised venture capital funding, developed its solid oxide fuel cell (“Bloom Box” / Energy Server) technology, and went public in 2018. From its early stealth years the company has focused on deploying on-site fuel cell power generation for commercial and industrial customers, and has since expanded manufacturing, global installations and service capabilities.