The Company

GE Vernova (ticker: GEV) is the energy-focused spin-off from General Electric that designs, manufactures and services the equipment and systems used to generate, transfer, convert and store electricity — including gas turbines and other power-generation equipment, onshore & offshore wind turbines, grid equipment (transformers, switchgear, HVDC) and electrification/energy-storage systems.

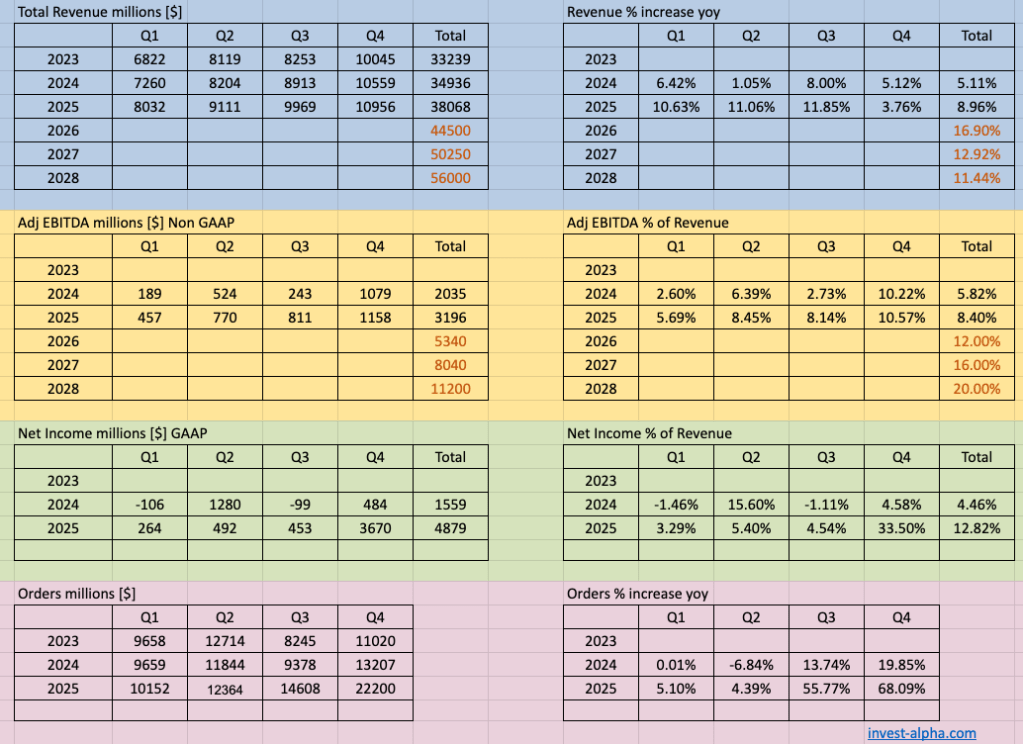

Financials

TAM / CAGR (market opportunity)

GE Vernova competes across several large electrification markets (power-generation equipment, electrical-grid equipment & HVDC, wind turbines and energy storage). A representative view of these adjacent markets: the global electrical grid market is in the low-hundreds of billions (~$268B in 2023) and is forecast to grow at mid-single-digit CAGRs into 2030; major submarkets such as HVDC and high-voltage equipment are growing at ~6–8% CAGR. Taken together, the combined addressable opportunity for GE Vernova’s product set is in the hundreds of billions of dollars with mid-single-digit to high-single-digit CAGR expectations over the next 5–10 years. (This reflects the sum of grid modernization, power-generation equipment and renewable equipment markets rather than a single consolidated “GE Vernova TAM”.)

Products (table — 2024 revenue / rough % split)

| Product / Segment | 2024 revenue (approx.) | % of total revenue (approx.) |

|---|---|---|

| Power (gas, steam, nuclear, services for generation) | $~18.1B | ~52% |

| Wind (onshore + offshore, blades) | $~7.6B | ~22% |

| Electrification (Grid Solutions, power conversion, storage, electrification software) | $~7.6B | ~22% |

| Total (FY-2024) | ~$35B | 100% |

GEV is the largest producer of gas trubines at 25% followed by Schneider at 24%.

Business Model

GE Vernova sells capital equipment (large, long-cycle orders for turbines, transformers, HVDC terminals and wind farms), after-market services (long-term service agreements, parts and maintenance), and increasingly software/automation for grid orchestration. Profitability depends on equipment volume and margin capture on large projects plus higher-margin recurring services and digital offerings. The company also pursues project-level deals and strategic partnerships (including co-development / site-delivery agreements) to place large-scale generation and grid projects. GE Vernova

Customers

Customers are utilities, independent power producers, major industrial users, developers of renewable projects and large hyperscale data-center / energy-intensive customers. Examples of customer use cases include utility grid upgrades (HVDC/substation projects), large gas-fired plants (including projects tied to data centers), and wind-farm developers for onshore/offshore turbines. The business has a mix of multi-year engineered equipment contracts and long-term service agreements. GE Vernova

Competitors (top 3 products that directly compete)

- Siemens Energy — competes across gas turbines, grid equipment (transformers, switchgear, HVDC solutions) and wind (via Siemens Gamesa/related units). Siemens is one of the closest full-scope rivals. Bloomberg

- Mitsubishi Power / Mitsubishi Heavy Industries — major competitor in large gas turbines and utility-scale generation equipment. Bloomberg

- Vestas / Other major wind OEMs (and Hitachi Energy for grid) — in wind turbines (Vestas, Siemens Gamesa) and in certain grid areas (Hitachi Energy competes in transformers, grid automation). Which of these is most relevant depends on the sub-market (wind vs. grid vs. gas). Global Energy Monitor+1

Founding History

GE Vernova was created when General Electric reorganized and spun off its energy businesses in 2024. The spin-out consolidated GE’s legacy energy units (power turbines, renewable energy, grid solutions and energy financial services) into a focused, publicly listed company (NYSE: GEV) aimed at leading electrification and the energy transition. The new company inherited GE’s long history and installed base in power and grid infrastructure while positioning itself as a specialist in decarbonizing electricity systems.