The Company

Coinbase Global, Inc. is a U.S.-based digital asset exchange platform founded in 2012 by Brian Armstrong and Fred Ehrsam. It enables users in over 100 countries to buy, sell, store, and trade cryptocurrencies, operating both retail and institutional products, including custodial services and stablecoin infrastructure. It is the largest U.S. crypto exchange and a major bitcoin custodian.

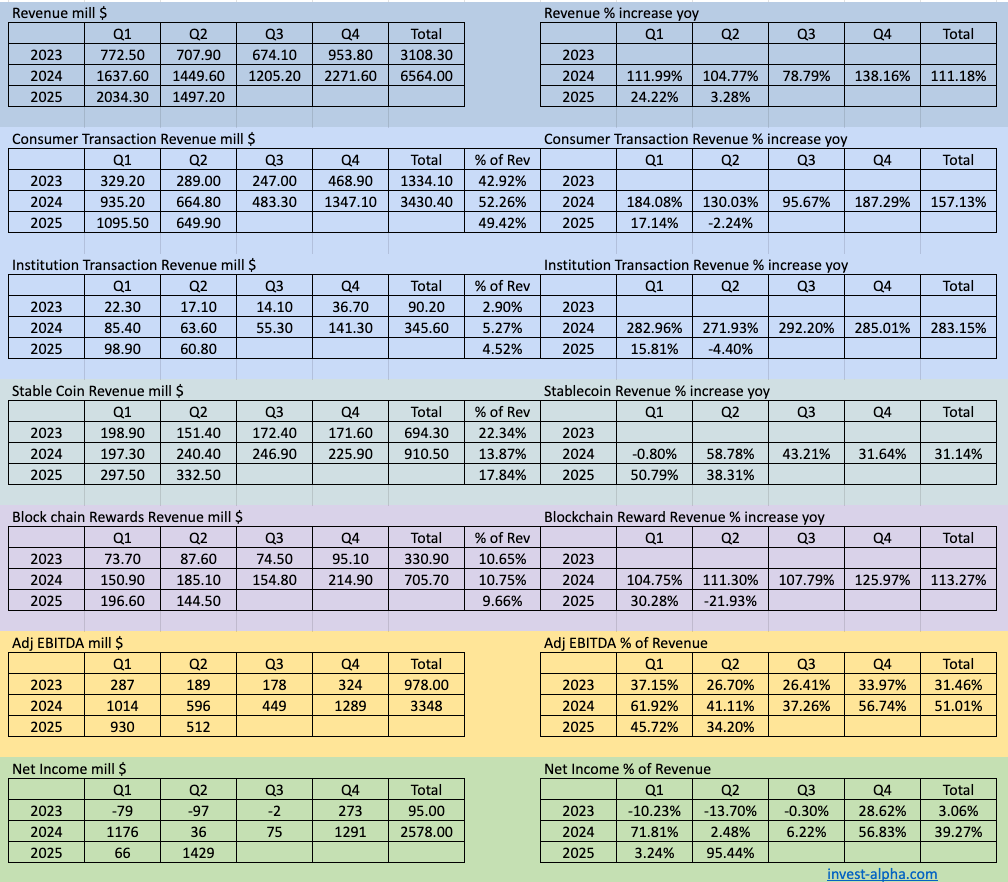

Financials

New Developments / Growth Areas from latest Earnings Call.

1. Crypto Trading

- Dramatic drop in Trading volumes and Transaction fees. Couple of reasons why this might be A) The rise of ETFs such as IBIT and ETHA mean lot of the trading has shifted to Tradfi brokerages such as Etrade. B) Altseason has largely not happened this season. Aside BTC and ETH, just a handful of utility coins such as CRV driven by other narratives such as Stablecoins have done well.

2. Coinbase is expanding derivatives trading volume through launch of broad set of CFTC-regulated crypto perpetual futures products in the U.S. Coinbase acquisition of Deribit will close by Dec 31st 2025, which will allow them to expand their portfolio of derivatives products.

Derivatives represents nearly 75% of crypto trading volume globally and US thus far has not participated much in this aspect. Thus, derivatives represents a significant growth area for Coinbase.

2. Stable Coin Financial Services

USDC on Base Chain now supported by Shopify Payments, Coinbase One Card and Coinbase Business.

Grew USDC use in Coinbase products through rewards program.

3. Custodian for Institutional Assets

Assets Under Custody (AUC) share reached an all-time high of total crypto asset market cap with $245.7 billion AUC driven by strong inflows from ETFs and Corporate purchases.

Coinbase is the custodian for over 80% of U.S. BTC and ETH ETF assets as of the end of Q2.

4. Tokenized Assets

The passing of GENIUS, CLARITY Acts will allow Coinbase to be a major player in tokenized assets.

5. Blockchain Stacking Rewards

TAM / CAGR

The global cryptocurrency exchange platform market was valued at about $33.4 billion in 2024, with forecasts reaching $63.4 billion in 2025, and further to around $150 billion by 2029, at a compound annual growth rate of ≈24 %

Other estimates suggest a broader exchange platform market size of $33 billion in 2024 to $88.8 billion by 2033 with CAGR of ≈11.2 %

Business Model

Coinbase primarily earns transaction fees from retail and institutional crypto trades. It also generates revenue from subscription and service lines—staking rewards (custodial share of staking yields), stablecoin floating interest (via USDC), blockchain rewards programs, financed interest and custody fees, and membership revenues (Coinbase One). It invests in crypto assets and strategic investments, realizing occasional one‑time gains. Coinbase also offers derivatives trading, prime financing, and institutional custody.

| Source of Revenue | % of Revenue |

|---|---|

| Consumer Trading Transaction Fees | 50% |

| Institutional Trading Transaction Fees | 4.5% |

| Stablecoin Revenue | 18% |

| Blockchain Rewards ( Fees earned from Proof of Stake Chains) | 10% |

Customers

Coinbase serves:

- Over 108 million retail users (traders, investors) globally.

- Thousands of institutional clients, including asset managers, corporate treasuries and fintech businesses

- Businesses and merchants via its “Coinbase Business” crypto operating account product

Competitors

Top 3 direct competitors offering similar exchange/trading services:

- Binance – global crypto exchange with spot and derivatives trading

- Kraken – U.S.-based platform for trading, staking, custody and institutional services

- Gemini – U.S. regulated exchange and custody provider, offers trading, staking and stablecoin issuance

Partnerships

Circle

As part of the 2023 restructuring of the Centre Consortium, Coinbase was granted 8.4 million shares in Circle equivalent to about 3.5% of Circle’s equity.

Coinbase also has a revenue-sharing agreement tied to USDC reserve income. It receives 100% of interest income from USDC held directly on Coinbase, and 50% of interest income from USDC held off-platform

Circle has full governance control over USDC.

Revenue earned from USDC.

Main Investors

| Investor | Approximate Stake in Coinbase |

|---|---|

| Brian Armstrong (founder) | ~19 % of total shares Wikipedia+1capital.com+1 |

| Marc Andreessen / Andreessen Horowitz (AH Equity Partners III) | ~6 % individual; institutional vehicles around ~4.8 % capital.com |

| Fred Ehrsam (co-founder) | ~3.8 % individual; plus ~1.65 % via Paradigm stake capital.com |

| Institutional investors overall | ~59 % held by institutions finance.yahoo.com |

Founding History

Coinbase was founded in June 2012 when Brian Armstrong (ex-Airbnb engineer) enrolled in Y Combinator with an initial $150k seed investment. Co‑founder Fred Ehrsam (formerly at Goldman Sachs) joined shortly thereafter. Early funding included a $5 million Series A led by Union Square Ventures in May 2013, and a $25 million round led by Andreessen Horowitz, USV and Ribbit in December 2013. Initially launched for U.S. bank‑based bitcoin buying, the company expanded rapidly through acquisitions, vault and insurance offerings, merchant integrations, and regulatory licensing (e.g. BitLicense). It later re‑branded its exchange platform to GDAX, added Ether trading, scaled globally, and shifted to a remote‑first structure in 2020. Coinbase went public via direct listing in April 2021 and continues expanding into stablecoin infrastructure, tokenization, derivatives, institutional services, and partnerships with major banks.