The Company

Hims & Hers Health, Inc. is a direct-to-consumer telehealth platform. They connect patients with licensed healthcare professionals, providing access to prescription and over-the-counter medications, as well as personal care products.

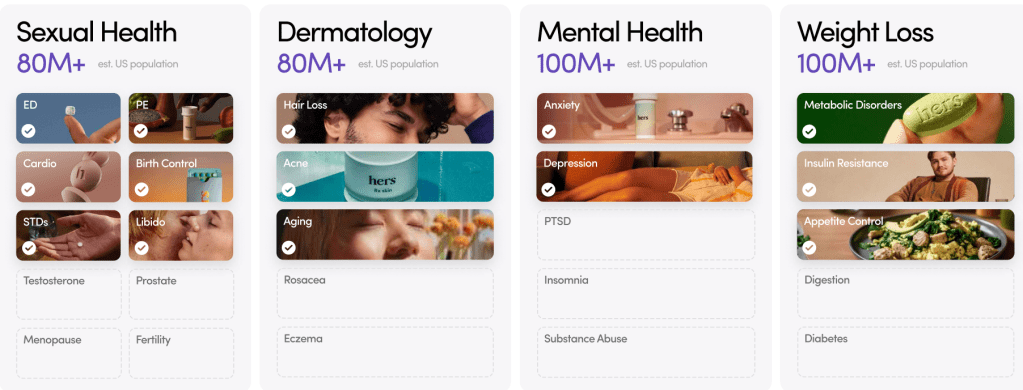

They specialize in conditions that are often not fully covered by insurance where people are already used to paying out-of-pocket or are frustrated with traditional healthcare access. The company’s services are in the areas of sexual health, hair loss, mental health, dermatology, and weight management.

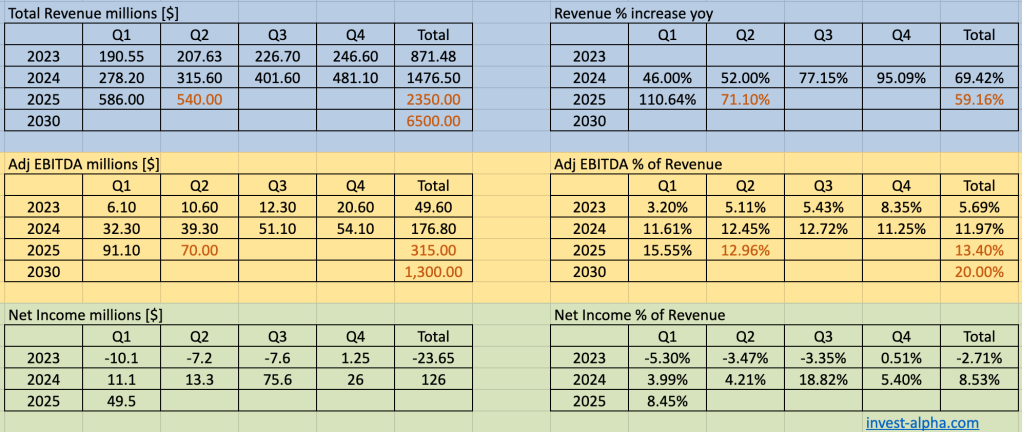

Financials

TAM / CAGR

The global telehealth market was valued at approximately $108.5 billion in 2023 and is projected to reach $851.0 billion by 2032, growing at a compound annual growth rate (CAGR) of 25.7% from 2024 to 2032.

Products

| Category | Products/Services |

|---|---|

| Sexual Health | Treatments for erectile dysfunction, premature ejaculation, and libido issues. |

| Hair Care | Solutions for hair loss, including topical and oral medications. |

| Mental Health | Services for anxiety, depression, and other mental health concerns. |

| Dermatology | Treatments for acne, anti-aging, and other skin conditions. |

| Primary Care | Consultations for common health issues and preventive care. |

| Weight Management | Programs and medications for weight loss and management. |

Business Model

1. Subscription-Based Telehealth Platform

Hims & Hers operates as a direct-to-consumer telehealth service, offering virtual consultations, prescriptions, and home delivery for various health concerns, including sexual health, hair loss, mental health, skincare, and weight management. Customers typically engage through monthly or prepaid subscription plans, which encompass medical evaluations, ongoing provider access, and medication delivery.

2. Pricing Overview (as of mid-2025)

- Weight Loss (GLP-1 Medications):

- Compounded semaglutide injections: Starting at $199/month, with discounts for eligible groups (e.g., $99/month for military personnel, teachers, and first responders) .

- Oral weight loss medication kits: Starting at $69/month with a 10-month plan .

- Branded Wegovy (semaglutide): Available through a partnership with Novo Nordisk at $599/month

- Erectile Dysfunction (ED) Treatments:

- Generic sildenafil (Viagra): Approximately $4–$5.50 per pill .

- Generic tadalafil (Cialis): Approximately $1.07–$4.50 per pill

- Mental Health Services:

- Medication management subscriptions: Ranging from $29–$49/month, depending on the subscription length .

- Therapy sessions: $99 per 50-minute session

3. Role of Compounding in the Business Model

Compounded medications have been a strategic component, particularly in the weight loss segment. By offering compounded versions of GLP-1 medications like semaglutide, Hims & Hers provided more affordable alternatives to branded drugs, especially during periods of high demand and limited supply. However, following the FDA’s removal of semaglutide from the drug shortage list, the company has phased out these compounded versions and now offers branded options like Wegovy through official partnerships

4. Vertical Integration and Customer Experience

Hims & Hers has developed a vertically integrated model, encompassing telehealth consultations, prescription services, and pharmacy fulfillment. This integration allows for streamlined services, cost efficiencies, and enhanced control over the customer experience.

Competitors

| Competitor | Where Hims & Hers Is Superior | Where Competitor Is Superior | Key Notes |

|---|---|---|---|

| Ro (Roman) | Better brand design, more consumer-friendly UX, strong compounding exit strategy | Larger product catalog (e.g., at-home labs), faster GLP-1 rollout | Ro is Hims’ closest DTC peer and very aggressive in GLP-1/weight loss |

| Keeps | Broader product line (not just hair), better platform experience | Lower cost for hair treatments, narrow brand focus | Keeps focuses solely on hair loss with strong pricing and specialist branding |

| Nurx (Thirty Madison) | More user-friendly interface, stronger male consumer targeting | Stronger presence in women’s health, broader asynchronous model | Nurx excels in female health, especially birth control and acne |

| Cerebral | More diversified (beyond mental health), stronger branding | Dedicated to psychiatric care, robust subscription options | Cerebral was a mental health pioneer but faced regulatory issues |

| Found | Broader health focus, stronger brand trust | More aggressive weight-loss support, coaching, GLP-1 integration | Strong competitor in GLP-1 space with subscription coaching |

| Calibrate | Better DTC marketing, wider product scope | Structured weight-loss program with strong medical coaching | Targets higher-income users with deep GLP-1 integration |

| Sequence (WW) | More flexible brand, DTC strength | Backed by WeightWatchers, large existing customer base | Recently acquired, strong GLP-1 competitor via WW |

| Teladoc | Better consumer UX, branding, affordability | Enterprise scale, insurance integration | Teladoc is more B2B-focused but competes via general telehealth |

| Amwell | More consumer-friendly for individual buyers | Strong hospital system partnerships | Less competitive in DTC but strong B2B partner |

| Amazon Clinic | Better UI, focused healthcare journey | Tightly integrated with Amazon Pharmacy and Prime logistics | Emerging threat; Amazon can scale quickly |

| CVS/MinuteClinic | Convenience, UX, and home delivery | In-person access, pharmacy integration | CVS is a hybrid threat with growing digital ambitions |

Founding History

Hims & Hers Health, Inc. was founded in 2017 by Andrew Dudum, Jack Abraham, and Hilary Coles as part of the Atomic Labs portfolio. Initially launched as Hims, the company focused on men’s health products, particularly treatments for hair loss and erectile dysfunction. In 2018, it expanded to include women’s health services under the brand Hers. The company continued to broaden its offerings to encompass mental health services and other wellness products. In January 2021, Hims & Hers became a publicly traded company through a merger with Oaktree Acquisition Corp., a SPAC, and began trading on the New York Stock Exchange under the ticker symbol “HIMS.”